- Home

- News & Alerts

- Technology Enhancement Notification (2019)

Technology Enhancement Notification

As part of our commitment to remain on the cutting edge of banking technology, we are pleased to announce that we are upgrading our computer processing system. Our enhanced system will help us continue to provide the extraordinary customer service you have come to expect while enabling us to offer the most up-to-date products and services.

Enhancement Time frame:

Start: Thursday, May 23, 2019, at 4 p.m.

Finish: Tuesday, May 28, 2019, at 8 a.m.

All PFB offices will be closed on Monday, May 27, 2019 in observance of Memorial Day.

With our new processing system, some changes will affect the products and services we provide to you. We want you to be aware of these changes and ask that you read this notification carefully to help ensure the transition to our new system causes you as little disruption as possible.

Accounts

Account Numbers & Checks

Your account number will not change. You may continue using your current checks and deposit slips. When you reorder checks or deposits slips, they will automatically be printed with the Planters First Bank name and routing number.

Automated Transfers

If you have set up Overdraft Transfer Protection or automatic transfers between your accounts through one of our Customer Service Representatives, these services will continue after the enhancement.

Telephone Banking

Telephone Banking will be unavailable Thursday, May 23, 2019 at 5 p.m. - Tuesday, May 28, 2019 at 8 a.m.

On Tuesday, May 28, 2019, our 24/7 Telephone Banking System will be updated with new features. Please listen carefully when you call as the menu options have changed.

HOW TO USE TELEPHONE BANKING

- Dial (877) 445-8814

- Follow the menu prompts

- Enter your Account Number & PIN

In order to verify your identity, the first time you call in you’ll need to enter your Account Number, followed by your Social Security number, and Date of Birth. This is the only time you will be asked to enter your Social Security Number and Date of Birth. You will then be prompted to re-register your Personal Identification Number (PIN). For account transactions and inquiries (balances, interest, etc.) you’ll always be asked to enter your account number and PIN.

Statements

Extra Cut-Off

Customers may receive two statements in the month of May. Regular statements will be sent out as usual, but statements will also be printed and mailed as of Thursday, May 23, 2019, when the enhancement takes place.

Interest will be paid and credited as accrued for both statement cycles.

Loans

Loan numbers and payment dates will stay the same. For customers who use a coupon book, you may continue to use your existing coupons when making payments.

Mobile Banking App

On Tuesday, May 28, 2019, you will need to delete your current PFB App and go to your Device’s App store and download the enhanced PFB App. (Apple Store for iPhone and iPad, Google Play for Android phones and tablets).

Once you download the App, please follow the instructions found below in the Mobile and Online Banking section to log in for the first time.

Mobile and Online Banking

Mobile and Online Banking will be unavailable Thursday, May 23, 2019 at 5 p.m. - Tuesday, May 28, 2019 at 8 a.m.

Personal User ID

If you are currently a registered personal Online Banking user, your Online Banking ID will be the same. Note: Your Online Banking ID was formerly known as your Username or Online Banking Login.

Business User ID

If you are currently a Company Administrator, your Online Banking ID will be the same.

In order to complete the initial setup, each Admin user must select the Cash Management tab located on the main navigation bar.

Password

To log on the new system on Tuesday, May 28, 2019, you will use a temporary password that will be the last 4 digits of your Social Security number or Tax ID. Business customers will need to use the last 4-digits of the TIN that is on that business profile.

Example customer:

John Smith

John’s Social Security Number: 999-88-7676

John’s temporary password: 7676

You will be prompted to select a permanent password for future use. Your password is case-sensitive and must be a minimum of 8 characters in length. Your password must include:

- a number,

- an uppercase letter,

- at least 1 lowercase letters, and

- a special character such as + _ % @! $ * ~

Security Data

If you are an existing Online Banking customer, you have used Multi-Factor Authentication for some time. You currently use device recognition to authenticate.

You will be prompted to verify by receiving a text, call or you can now use an App called Authy.

Authy is a free Multi-Factor (2FA) App. 2FA is sometimes referred to as two-step verification, or dual-factor authentication is a security process in which the user provides two different authentication factors to verify themselves to better protect both the user's credentials and the resources the user can access.

You can download Authy for phone/tablet by visiting your App Store on your device or Install directly from the Authy Website to your desktop computer.

Browser Security Update

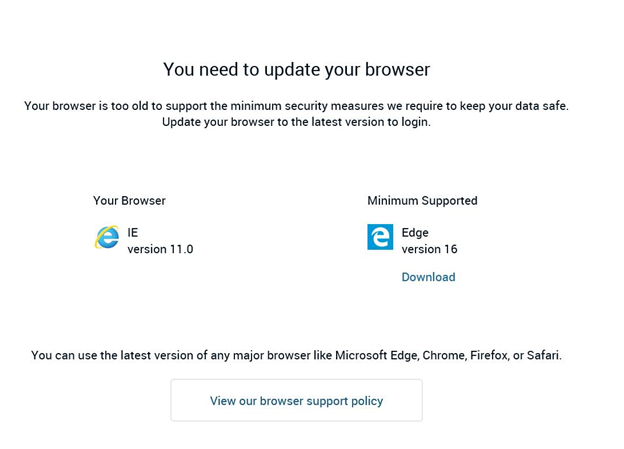

If you are using an older version of an internet browser, it could put your computer/device security at risk. With our enhanced Online Banking and Mobile Banking, it will require you use the latest version of the browser you are using like Microsoft Edge, Chrome, Firefox or Safari. If you use Internet Explorer at login, you will be prompted to download the latest Version of Microsoft Edge, and a link to download will be provided. See screenshot below.

Email Address

Once you log in, please go Setting/User and update your email address in your Profile. This will allow us to notify you when your statements are available.

Check Images & Statements

Statement and Check Images produced after Thursday, May 23, 2019, will be available. Be sure to view or download all statements prior to Thursday, May 23, 2019, at 4:00 pm for our current Online Banking system.

Once available you will be able to view your Statements and images of checks through PFB’s Mobile App.

Recurring Loan Payments

If you previously set up recurring loan payments within Online Banking, we anticipate that these will carry over in the new system. Please confirm your recurring loan payments by clicking on the “Transfer” link.

Automatic Transfers

If you previously set up automatic, recurring transfers within Online Banking, we anticipate that these will carry over in the new system. Please confirm your automatic transfers by clicking on the “Transfer” link.

Alerts

If you set up alerts in Online Banking, they will not carry over to the new system. To create alerts in the new system, go to Settings/Manage Alerts. You will need to verify your contact information. Under the two categories, Balance and Transaction Alerts choose +Add alert.

Cash management will have additional CM-specific (e.g. wires) alerts within the Cash Manager tab > Settings.

Online Bill Pay

During PFB’s system enhancement, which is scheduled to begin on Wednesday, May 22, 2019, through Tuesday, May 28, 2019, your Bill Pay will be disrupted for a short time. This system enhancement DOES NOT require you to re-enter your existing biller relationships or alter your recurring or future dated payments. For eBill users, there WILL be one additional step required, and you may temporarily receive a paper bill in order to initiate your payment. If you have automatic payments in response to an eBill presentment, they will be discontinued until you have re-enrolled into the eBill service.

If your Bill Payment is set to be paid/process on Friday, May 24, 2019, there will be 1 business day delay. So, this means the payment will not be processed until Tuesday, May 28, 2019. Please adjust your payments for this delay.

Here’s what you can expect when your Online Bill Pay enhancements on Tuesday, May 28, 2019.

- You will be prompted to create an answer a challenge phrase the first-time logging into your Online Bill Pay account. This is an enhanced security that happens when making changes to your Bill Pay profile info.

- All of your payees and any scheduled payments will automatically carry over to the new system.

- 12 months Bill Pay history is provided for both retail and business

ebill Users

On Thursday, May 16, 2019, eBill links will no longer be available in your current Bill Pay. If you currently are using eBill we recommend that you make a list of the eBills you are currently receiving, noting the following:

- The payee name

- Due date of the last bill received

- Date paid (if paid before the system enhancement)

- Amount paid (if paid before the system enhancement)

Following your normal log-in, you will see links on your biller list inviting you to “Set up eBills”. Simply click the link and follow the online instructions. Upon re-enrollment of the eBill service, your billers may provide a duplicate bill. Please review your list against the bills presented and watch for any of the following situations:

- The bill presented is for the next month than the one on your list – PAY this bill.

- The bill presented is for the same month and amount as the one on your list –this is a duplicate bill, only pay if you have not paid before the system enhancement. If you have paid it before the system enhancement, click FILE BILL.

- A paper bill was received in the US Mail – pay this bill and watch for eBill in the coming months.

- No bill was presented nor received in the US Mail around the usual receipt date -contact the biller and verify your account due date and amount due.

It is also recommended that prior to Thursday, May 23, 2019, you record the last eBill received and paid in order to monitor the flow from eBill to paper and then back to eBill.

Please follow the eBill Handouts below to assist you in re-enrolling in the eBill service. If you have a question, please contact PFB Toll-Free at (800) 684-8118.

Mobile Deposit and Commercial Remote Deposit

Beginning Monday, May 20, 2019, at 4:00 pm you will be unable to make your deposit electronically through Mobile Banking or the Commercial Remote Deposit products.

Debit Cards

There will be no impact on your current debit card with PFB. Please continue to use your card as you normally do.

For Assistance

Online Info Center

To learn more about the changes that will take place, please visit our website www.bankplanters.com. You’ll find demos for our new systems and answers to many commonly asked questions.

Customer Care Center

To help you with any needs you may have during the enhancement, you may call any branch location or use our toll-free number: (800) 684-8118.

Commercial Clients & Treasury Management Customers

If you need assistance related to commercial services such as Remote Deposit, Positive Pay, or recurring wires, please call (478) 892-4024.