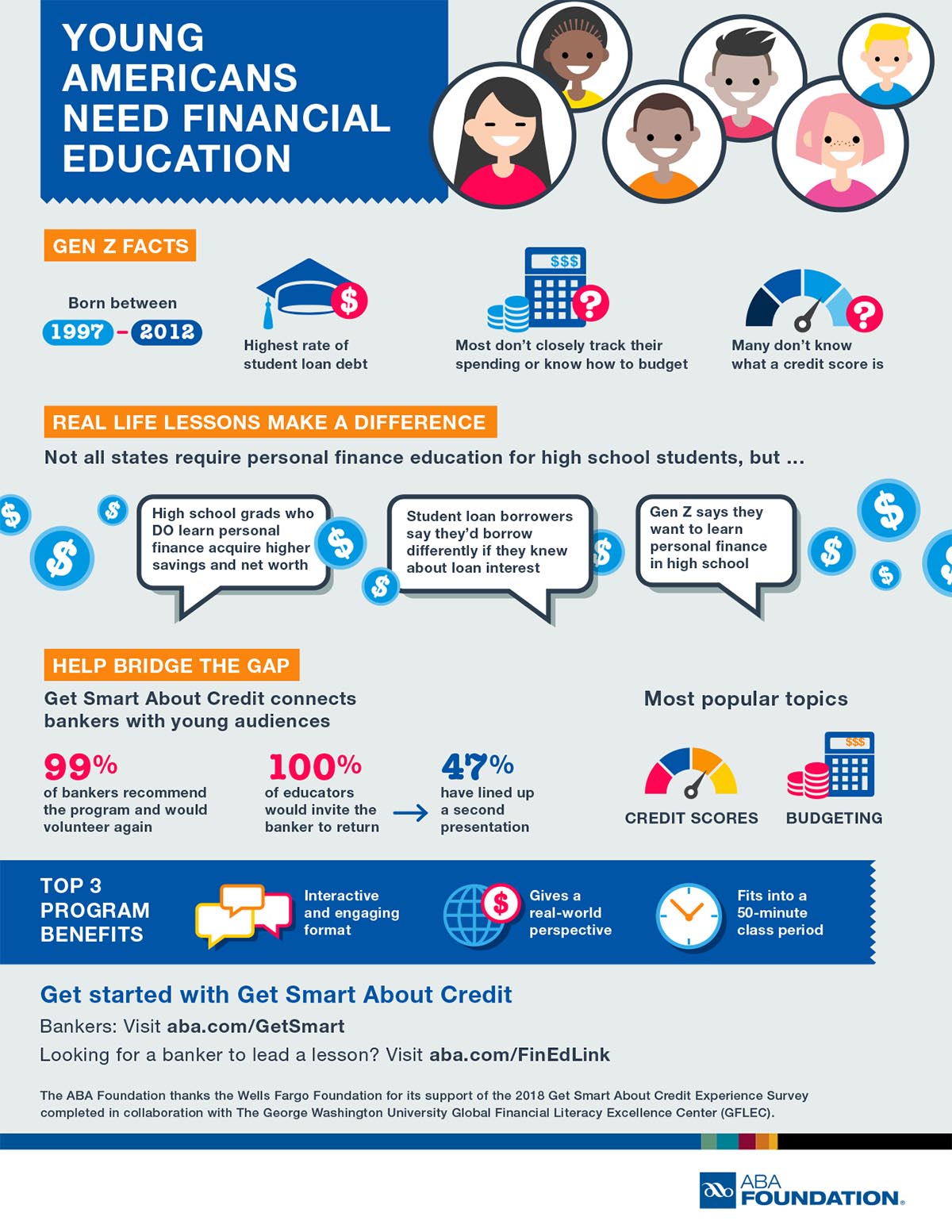

Planters First Bank is making significant strides in promoting financial literacy and career readiness among teens and young adults through its active participation in the American Bankers Association (ABA) Foundation’s national campaign, Get Smart About Credit.

Every October, Planters First Bank joins hands with banker volunteers across the nation to educate high school students and young adults on essential personal finance skills. These skills include managing credit wisely, handling money responsibly, safeguarding their identity, understanding college financing options, and exploring career opportunities within the banking industry.

Below are links to helpful teaching tools provided by the ABA Foundation.

|

|

|

|

| Need help making a monthly budget? Use this worksheet from ABA's Get Smart About Credit program: https://aba.social/46no9WT | Developing a habit of saving early on is a great way to ensure you are prepared in case of a financial emergency. Use these tips from ABA to help: | A credit report is essentially your financial resume - a file on you that can be accessed by potential employers, landlords or insurance companies. How can you establish a good credit history? Get Smart About Credit and find out here: https://aba.social/464OBoB | |

|

|

|

|

| Figuring out how to finance your higher education can be overwhelming. Access a list of useful websites, scholarship opportunities and apps that you can trust: https://aba.social/39bc6Ak | Consumers across the country are in the process of exploring student loan debt forgiveness opportunities following the Biden administration's announcement in late August. As they do so, it’s important they remain on high alert for suspicious behaviors that may indicate a criminal scheme. Learn how to spot student loan forgiveness scams in this #GetSmartAboutCredit infographic from ABA: https://aba.social/3CLkMNl | College costs are rising. Looking for a loan? You're not alone. Be wary of the information you share, and where. Find out more in ABA's #GetSmartAboutCredit infographic on scholarship and student loan scams: https://aba.social/3cPurZl | |

|

|

|

|

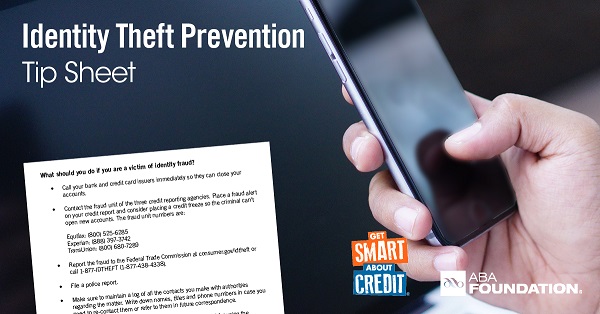

| Don't become a victim of identity theft! As young people become more financially independent, they are at an increased risk of being targeted by scammers. Use these tips from ABA to learn how to spot and prevent identity theft: https://aba.social/3zaMUof | So you've joined the millions of others that are victims of identity fraud each year. What now? Follow these steps from ABA: https://aba.social/3nyyGv6 | Millions of people are victims of identity fraud each year. As young adults become more financially independent, it's important for them to understand this form of theft so they don't fall prey to scammers. Use this info sheet from ABA to help your teen understand identity fraud: https://aba.social/3EeYa6J |